Your household finances

Income Checking account Spending Bills Credit cards Sinking funds SavingsAt the core of your day-to-day finances is at least one checking account. This is an account that you open at a bank or credit union. You deposit money into this account for both safekeeping and to make the money conveniently available to you as cash, for making payments and purchases, or to transfer money to other types of accounts.

The term checking account is relatively modern. The practice of writing instructions on a serialized piece of paper to access money held by a cashier first appeared in Holland in the early 1500s. That practice spread and eventually became the modern checking account with preprinted, serialized checks being issued to the account holder who used a check register, a hand written, preformatted log or journal, to keep track of checks that were written as well as other account transactions.

The check register is how a person keeps track of how much money, the account balance, is available for their use. A check register is needed by the account holder because the account balance maintained by the bank or credit union does not include the checks that had not yet been cleared: received and deducted from the account.

With the advent of computers and the Internet, the name checking account for many may seem out of date. With each new generation the idea of writing checks to make payments or withdraw cash from their checking account is losing ground to electronic methods. For example, a debit card, which is fundamentally a reusable, plastic check, is used along with a personal identification number (PIN) instead of paper checks.

The check register is disappearing as well. It is either not used at all or is replaced with a computerized version such as a spreadsheet. The practice of manually keeping track of checking account transactions has been abandoned to the point that the term check register no longer appears in the vocabulary of younger wage earners. They have no idea what a check register is. In addition, the name checking account is beginning to morph into debit account, reflecting the increased use of debit cards.

Regardless of how you handle it, something like a checking account is typically the hub of your day-to-day household finances. It is the one place through which your money can flow from the sources of your income to the monetary destinations that you choose. It is this flow of cash through one checking account that you manage with You Need A Cash Plan.

There are several types of checking accounts offered by banks and credit unions. This is an introductory list intended to show you some of the unique features by type of account. When looking to open a checking account, consider the alternatives such as fees, availability of branches and ATMs as well as minimum balance requirements to find a checking account that works best for you.

| Checking account | Unique features | Typical user |

| Traditional | Checks, debit or ATM card, online bill payment | Anyone wanting to pay bills and use a debit card |

| Premium | Free checks, money orders and safe deposit box, waived out-of-network ATM use | People who can maintain a high account balance |

| Student | Overdraft forgiveness, ATM fee reimbursement, free checks | Students aged 18-23 |

| Senior | Free checks, no monthly fees | People ages 55 or 60 and older |

| Interest-bearing | Pays interest on the account balance | People with a high account balance |

| Business | Business checks, accept credit and debit card payments | Business owner |

| Checkless | Debit card, online bill pay | People who have no need to write paper checks |

| Rewards | Cash back or points on purchases made with a debit card | People who make frequent debit card purchases |

| Private bank | Access to a private banker, higher interest rates on deposit products, lower interest rates on loans, free safe deposit box | People who can maintain the needed high minimum balance |

| Second-chance | Service fees, no overdraft protections | People who have been denied other checking accounts |

An overdraft (non-sufficient funds (NSF)) happens when more money is withdrawn from a checking account than is available in the account. When a checking account has overdraft coverage, a check that causes an overdraft is honored by the bank or credit union and you are charged an overdraft fee. If the checking account does not have overdraft coverage, a check that would cause an overdraft is returned as NSF. You are not charged a fee by the bank or credit union, however, the business to which you gave the NSF check may try to collect from you both the amount of the returned check and a returned check fee. If you gave an NSF check to a person the result could be a strained relationship including the exchange of strong words.

For example, you have $50 in your checking account and write a check for $75.

Here are the overdraft fees at a few popular financial institutions as of August 2024.

| Wells Fargo | $35 |

| Bank of America | $10 |

| Chase | $34 |

| USAA | $29 |

| Capital One | $0 |

| Ally Bank | $0 |

Overdraft fees can be expensive, but are avoidable by opting out of overdraft coverage when you open a checking account and using one of these options.

While deposits may seem trivial, how you deposit the income that you manage with You Need A Cash Plan is a key part of successfully planning how you will use your income.

Your future spending and saving plan will work only if the amount of each paycheck deposit is never less than the expected amount. A paycheck deposit can be more than the planned amount, but never less. The catch phrase for income is "plan low and deposit high."

Getting back cash when you deposit a paycheck by depositing less than the check amount is a habit that is best avoided. Accurately planning how you will use your money in You Need A Cash Plan is possible only when at least the amount you expect to receive is actually deposited as scheduled.

The recommended way to avoid the cash back habit is to have your paychecks directly deposited. When you sign up for direct deposit, your money is electronically sent to your checking account on payday. You do nothing other than record the deposit in You Need A Cash Plan.

Direct deposit is a trusted technology that is dependable, quick, and very convenient. Having your paychecks directly deposited to your checking account:

A debit card lets you spend money from your checking account without writing a paper check. When you pay with a debit card, the money comes out of your checking account immediately. There is no bill to pay later.

With a credit card it's easy to purchase anything you want, even if you don't have the funds. With debit cards, you avoid spending more money than you have. However, with a debit card, it’s easy to spend more than you have in your checking account. The resulting overdraft fees can be more than the interest charged on credit cards.

Merchants tend to dislike debit cards because they limit purchases to the balance in a customer’s checking account. Credit cards are not so limited and, thereby, can encourage more spending. Merchants pay the same processing fee for debit card transactions that they pay for credit cards, but their potential sales with debit cards are typically lower than with credit cards.

When renting a room or car with a debit card, the money in your checking account could be locked to cover unexpected charges. Often the lock on your checking account isn’t lifted until several days after you check out or return the rental car. With a credit card, any unexpected fees are covered with additional charges.

Debit cards are more vulnerable to fraud than credit cards, according to the Identity Theft Resource Center in California, a nonprofit consumer education organization. The reason: account monitoring isn't as thorough for debit cards because the transactions are processed through different networks. In addition, using debit cards at gas stations, deli kiosks, and other unattended locations are vulnerable to “skimming” which can be done two ways.

Recovering cash stolen from your checking account with your debit card is possible, but not guaranteed. And, you may not have access to your money while a refund is being processed

The safest way to use debit cards is only at on-site ATMs for deposits and withdrawals. For all other transactions, especially at off-site ATMs and unattended locations, credit cards are safer.

Here’s a quick comparison of credit and debit cards.

| Credit card | Debit card |

| Money is borrowed from the card issuer. | Money is deducted immediately from your checking account. |

| Spending limit is set by the card issuer. | Spending limit is the balance in your checking account. |

| Interest rates and fees vary. | No interest charges. May have overdraft fees. |

| Helps you build credit. | Does not help you build credit. |

| Overspending can lead to debt. | No accumulation of debt. |

| Offers fraud protection. | Limited fraud protection. |

| 60 days from statement date to dispute fraudulent charges. | 60 days from statement date to dispute fraudulent withdrawals. |

| Regulated by Fair Credit Billing Act. | Regulated by Electronic Fund Transfer Act. |

| May offer rewards. | May offer rewards. |

A checking account statement is a detailed summary provided by a bank or credit union that shows all the activity in a your checking account since the previous statement. It's an important document for reviewing your spending, ensuring that your records agree with the bank or credit union, and finding any unauthorized transactions. The parts of a checking account statement include:

Banks and credit unions are not required to send you a monthly statement unless you make at least one electronic fund transfer in a month. Electronic fund transfers include:

You will normally have the option of receiving your monthly statement on paper or electronically.

Verifying your monthly bank or credit union statement against your records is how you ensure that your records agree with the bank or credit union. Balancing your monthly statements is how you:

Statement errors and fraud must be reported to the bank or credit union as soon as possible. Account holders typically have as little 30 days to dispute errors, but timelines vary by account and state.

It's a good idea to have access to your bank or credit union statements for the last twelve months.

A checking account is a type of bank or credit union account designed for everyday financial transactions. Here's a straightforward outline of how to use one.

Personal checks are a traditional method of making payments, typically used for transactions like paying bills or making in-person purchases. While paper checks are being replaced by debit cards, they are not entirely dead. The Federal Reserve reported that the volume of checks written in the U.S. dropped from 50 billion in 1995 to 11.2 billion in 2021. Still a respectable number.

The following are the most important benefits that paper checks offer:

Even though you may be totally into going cashless with apps and debit cards, being able to write a paper check is still a financial skill that you may need occasionally. It doesn’t hurt to have a book of checks lying around, and know how to use them, in case a need arises.

Paper checks can be ordered from the bank or credit union where you opened your checking account or from third-party vendors. The checks are a standard size and are generally printed in pads of 40 checks. The checks you order will probably come with free check registers, which you will not need for the checking account you manage with You Need A Cash Plan. The program maintains your transaction register for you.

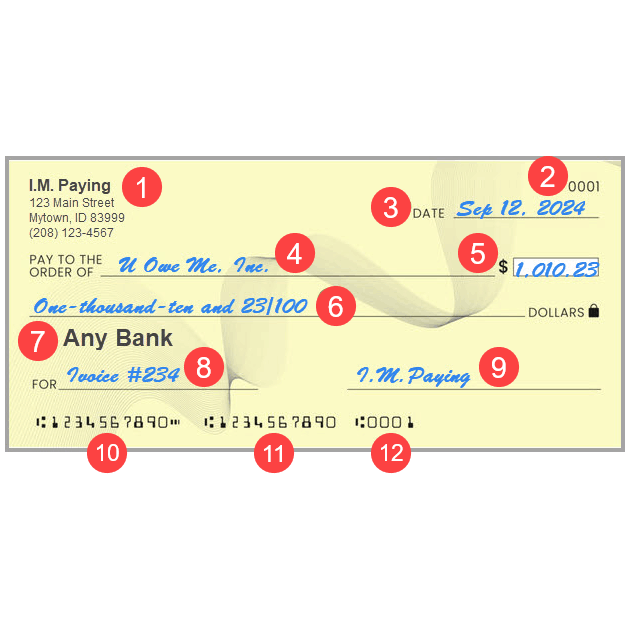

The parts of a check are normally arranged as illustrated, but there could be variations in format.

1 - Your name and address. Including your phone number simplifies using checks at stores that require it. Do not include your social security number.

2 - The printed number of the check.

3 - The date you write the check or a future date for a post-dated check. The check is not valid until this date.

4 - The person or company to whom you are paying the money. How this name is written may be important to whoever is receiving the check, as their account may require a specific spelling.

5 - The numerical amount of the check.

6 - The amount of the check written in words.

7 - The name of your bank or credit union. Their address and logo may be included.

8 - The memo line. You can optionally write the purpose of the check or reference information that will aid the payee in identifying where the money is to be applied. An example is writing an invoice number. Another example could be “Happy birthday!”

9 - Your signature formatted as on file with your checking account at your bank or credit union.

10 - The routing number. This is a unique, nine-digit number that functions as an electronic address for your bank or credit union.

11 - The number of your checking account in machine readable format.

12 - The check number in machine readable format.

Filling out a check correctly is important, as any errors or omissions can cause a check to be invalid. Keeping track of the checks you have written is not required; however, doing so will enable you to balance your bank account statements. When using You Need A Cash Plan, the program helps you balance your statements against your automated transaction register.

To write a check, enter the following information.

(3) Today’s date or the date when the check will be valid

(4) Name of the payee

(5) Numerical amount of the check (e.g. 1,010.23)

(6) Amount of the check in words (e.g. one-thousand-ten and 23/100)

(8) Purpose of the check, if needed

(9) Your signature

If you are using a manual check register, enter the check. If the check is drawn on the checking account you are managing with You Need A Cash Plan, enter the check in the program using the Enter fee/Write a check function.