The smart way to view your cash

How your household cash flows A quick tour Your net cashflow Compare YNACP vs. budgetingYou use You Need A Cash Plan to manage your current income AND plan how you will use your future income. To understand how the program works, you need a basic understanding of how your household cash flows because your everyday money and You Need A Cash Plan both work the same way.

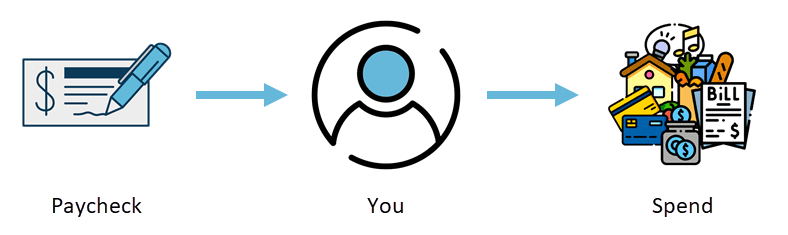

Let’s go back to the beginning and start with the natural way that cash flows through our lives.

This simple view hides the detail of how your everyday money flows. The first step toward understanding this cash flow is to add the details so you can see the whole picture.

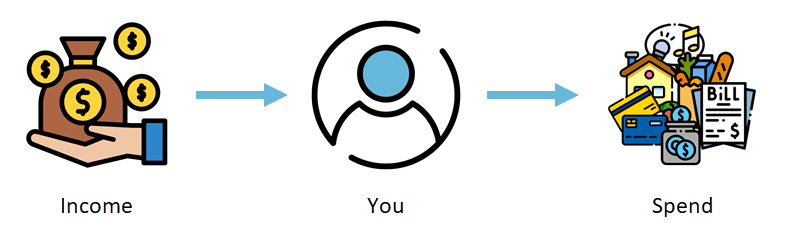

“Paycheck” is limiting in that it implies that there is only one type of income when there are actually three types. To show a more inclusive view of how you receive your money, let’s replace Paycheck with the more generic Income.

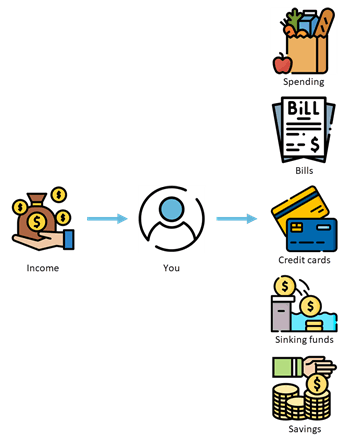

While there are unlimited ways in which you can spend your money, the choices that you have for using your income, both now and in the future, fall within one of five categories:

Adding these categories to your cash flow, as illustrated below, gives you the entire picture of how your everyday money flows.

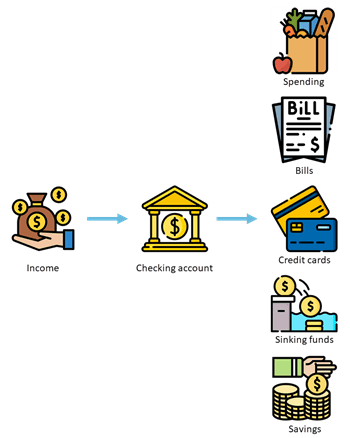

What’s still missing is a useful link between income and outgo. Your wallet (real or digital) is not an acceptable conduit. What you need is a safe place to temporarily store your income that is easily accessible online. A checking account at a bank or credit union fits the bill.

With a checking account as the intermediary between income and outgo, you have a model of personal finance that applies to everyone. If you have income, regardless of how much you earn, this model gives you an overview of what is, or could be happening to your everyday money.

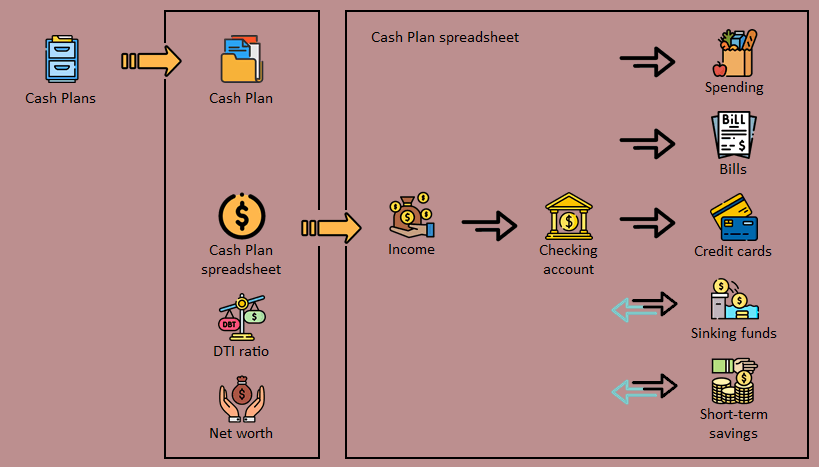

The above model of personal finance is the basis for the design of You Need A Cash Plan. The model is shown on the right side of the program's Help page in the Cash Plan spreadsheet panel. Each of the icons in this panel, except for Checking account, correspond to an element, or group, in your cash plan spreadsheet.

The center panel of the Help page shows that a cash plan is comprised of a Cash Plan spreadsheet plus Debt-to-income ratio and Net worth pages. The Cash Plans icon on the left side of the Help page indicates that you can create an unlimited number of cash plans.

As illustrated on the Help page, when you use You Need A Cash Plan you are managing your household finances in the same way that your money happens.