Make friends with your money

See the rhythm. Understand the timing. Let your financial life finally make sense with You Need A Cash Plan.

See the rhythm. Understand the timing. Let your financial life finally make sense with You Need A Cash Plan.

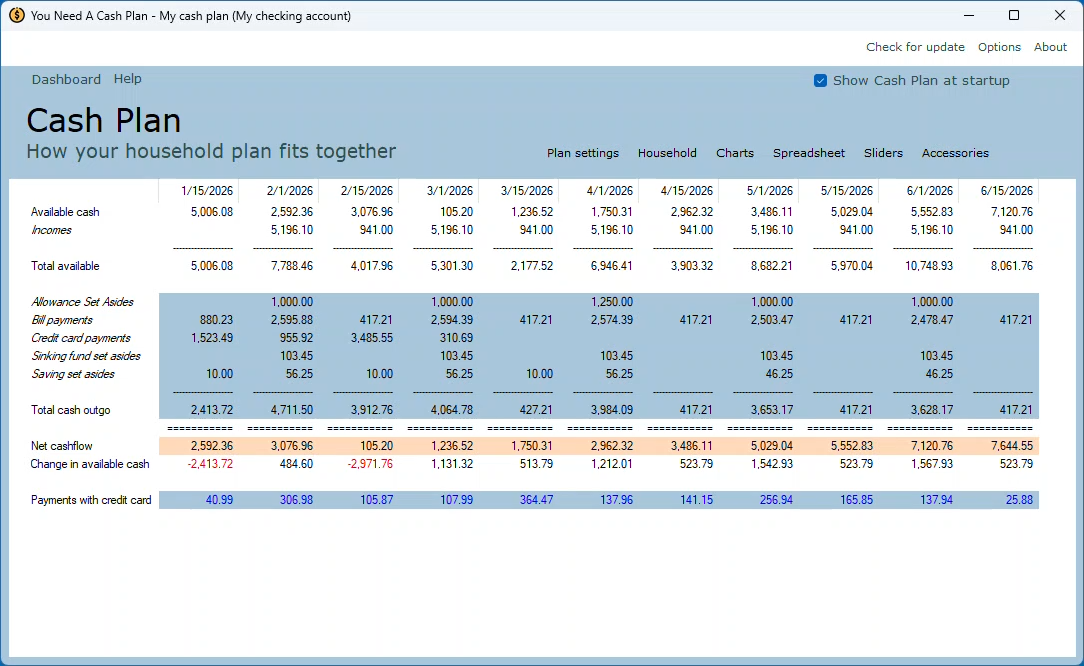

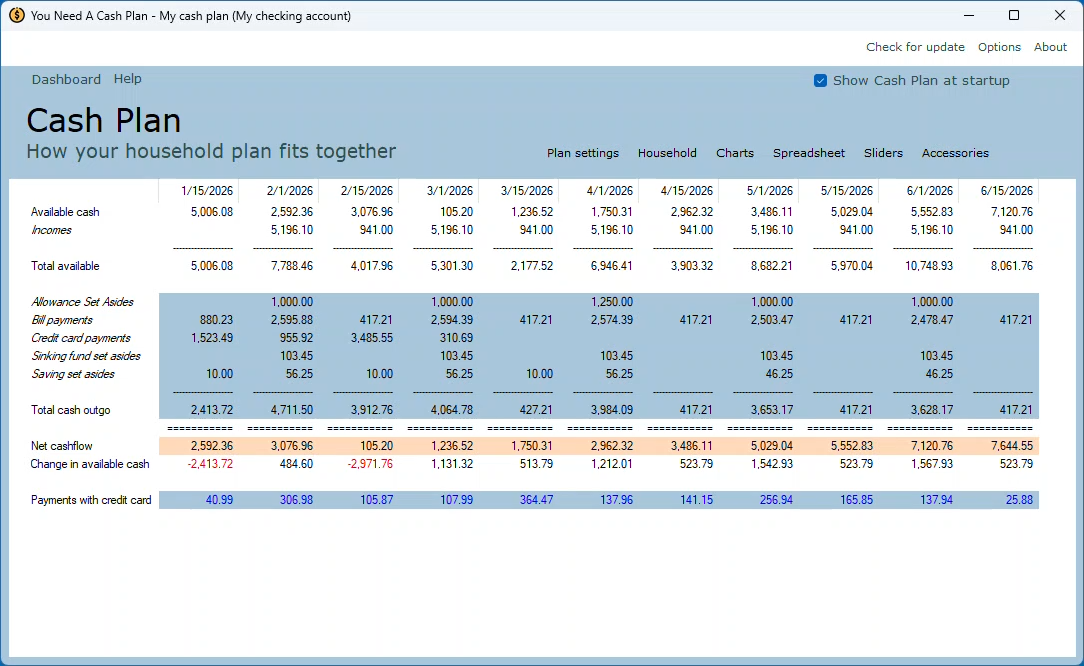

Traditional budgeting is focused on this month or your next paycheck. You Need A Cash Plan stretches your vision to a full twelve months of upcoming income, spending, bills, credit card activity and payments, sinking funds, and savings.

This broader view is what makes everything else possible. Once you can see the rhythm of your financial life, you can manage it with confidence.

You Need A Cash Plan replaces the randomness of paydays with a steady structure built around your actual income. Instead of reacting to whatever bill happens to be due next or waiting for the “right” payday, the program organizes your money into a predictable, repeatable rhythm that works for every household.

By converting your income into weekly spending power and mapping the full year of bills, savings, and obligations in advance, You Need A Cash Plan removes timing guesswork and creates a uniform system you can rely on no matter how you’re paid or how often your income arrives.

You Need A Cash Plan works for everyone—whether a household earns a little, a lot, or something in between—because it focuses on timing, not wealth. By mapping out when money comes in and when it needs to go out, You Need A Cash Plan gives every person a clear picture of their cash flow, allowing them to make confident decisions, reduce stress, and stay in control.

It’s not about having “extra” money; it’s about seeing the rhythm of the money you already have and using it with intention.

You Need A Cash Plan works with any income type, payday schedule, or mix of earnings because it’s built around real-world cash flow. Whether income arrives weekly, biweekly, monthly, irregularly, seasonally, or from multiple sources, You Need A Cash Plan simply places each deposit on the timeline and shows exactly how it supports upcoming bills, spending, and savings.

No matter how complex the income pattern is, You Need A Cash Plan brings clarity by letting the timing of your money tell the story.

With You Need A Cash Plan, you stay in control of everyday spending by giving yourself a weekly allowance: on the day you choose and in the amount you choose. This simple rhythm creates structure without restriction, ensuring your essentials are covered while giving you a predictable, judgment-free pool of money for groceries, gas, and daily life.

You decide the schedule, you decide the number, and You Need A Cash Plan keeps everything aligned with your bigger cash-flow plan.

You Need A Cash Plan works with any type of bill, on any payment schedule, in any combination because it organizes them by timing rather than category. Whether your bills are monthly, quarterly, annual, fixed, variable, or scattered across multiple due dates, You Need A Cash Plan places each one on your cash plan so you always see what’s coming and which income covers it.

No matter how complex the mix, the cash-flow view in You Need A Cash Plan keeps everything predictable and manageable.

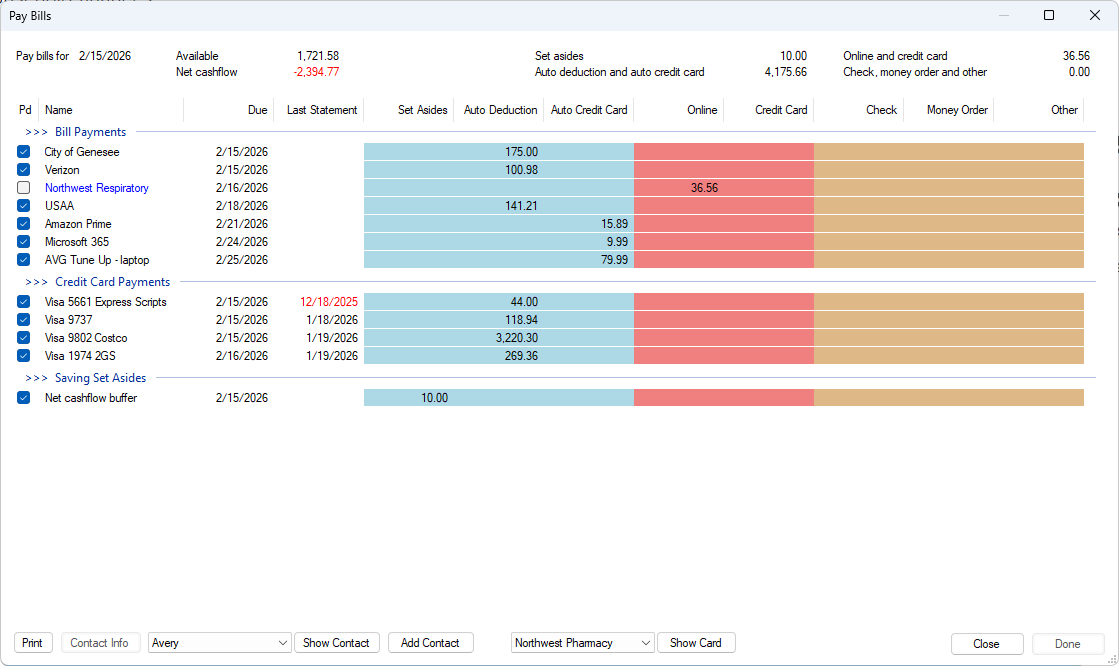

You manage your credit cards in You Need A Cash Plan using a clear four-step method that keeps you organized and in control. First, you keep receipts or reminders of every authorized charge. Second, you enter new activity into your cash plan and adjust scheduled payments so you instantly see the impact on cash flow. Third, you reconcile each monthly statement to confirm every charge and catch fraud quickly. And fourth, you pay the full statement balance on time—ideally with automatic payments—to avoid all interest and fees.

You use sinking funds in You Need A Cash Plan to help you “save up” for future purchases by setting aside small amounts of money over time. Whether the goal is short-term—like new tires or Christmas gifts—or long-term, such as a vacation or a down payment, You Need A Cash Plan automatically maintains each sinking fund once it’s set up and shows how each contribution affects your cash flow.

By treating these set-asides as expenses, You Need A Cash Plan makes future needs visible today so you’re always prepared when the time comes.

Savings in You Need A Cash Plan are designed to help you set aside today’s income for tomorrow’s needs, giving every household a simple way to prepare for both expected and unexpected expenses. Savings can be short-term—like emergency funds, periodic expenses, or ongoing costs—or long-term, such as retirement, investing, or building an unemployment reserve. Each type of savings can be funded in different ways: as a percentage of income, a fixed amount on a schedule, or only when extra money is available.

You Need A Cash Plan treats savings as an expense so your cash-flow plan always shows what’s truly available to spend, while still helping you build the future you want.

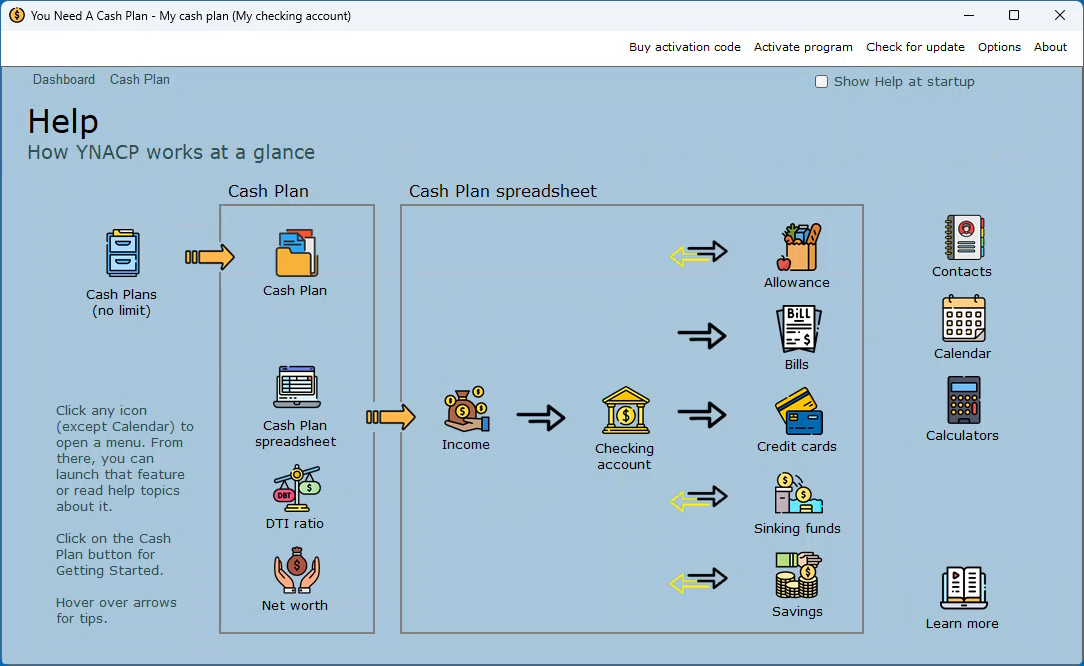

You Need A Cash Plan is a practical, complete household-finance system. By focusing on timing, clarity, and the full twelve-month rhythm of your income and expenses, it supports every money activity that actually matters—not just spending categories.

* Debt reduction

* Savings strategy

* Emergency-fund automation

* Loan planning

* Big-expense planning

* Seasonal expenses

* Transaction management

* Credit card usage strategy

* Cash-flow timing

* “What if?” testing

* Financial-health measurement

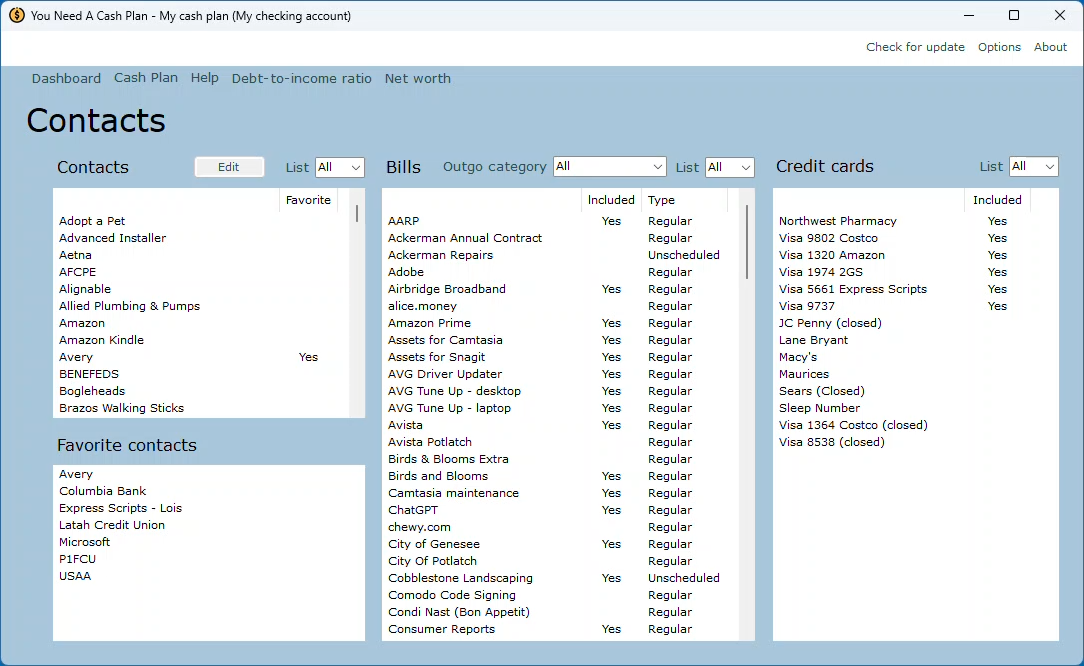

* Contact organization (shown)

* Stress reduction—because you always know what’s coming

Beyond the cash plan itself, You Need A Cash Plan supports the tasks that make household money management easier and far more organized:

- Automatic transaction register

- Use downloaded transaction files from any bank, credit union, or credit card website for semi-automatic checking-account balancing and credit-card reconciliation

- Automatic emergency fund contributions

- Short-term savings with fixed, percentage of an income, or unscheduled set-asides

- Link sinking funds and savings, so bill and credit card payments automatically use the right set-asides

- Keep contact and login information for bills, credit cards, people, and companies

- Enter deposits, get weekly allowance, update upcoming bills, and more

- Never expose your online account credentials—You Need A Cash Plan doesn’t connect to the Internet

It’s like finally having a central command center for your household finances.

With budgeting, your daily and weekly routine is heavy: track spending, categorize purchases, compare budgeted vs. actual, adjust categories, rebalance monthly…

With You Need A Cash Plan, the ongoing routine is simpler and predictable because every dollar in your future has already been assigned in your twelve-month plan.

Your ongoing activities include:

* Entering deposits

* Getting your weekly allowance

* Adjusting next bill payment amounts

* Entering credit card activity

* Paying bills twice monthly (example shown)

* Balancing checking account statements

* Reconciling credit card statements

* Adding/using sinking funds

* Adding/using short- and long-term savings

Instead of micromanaging categories, you’re maintaining a system that already works.

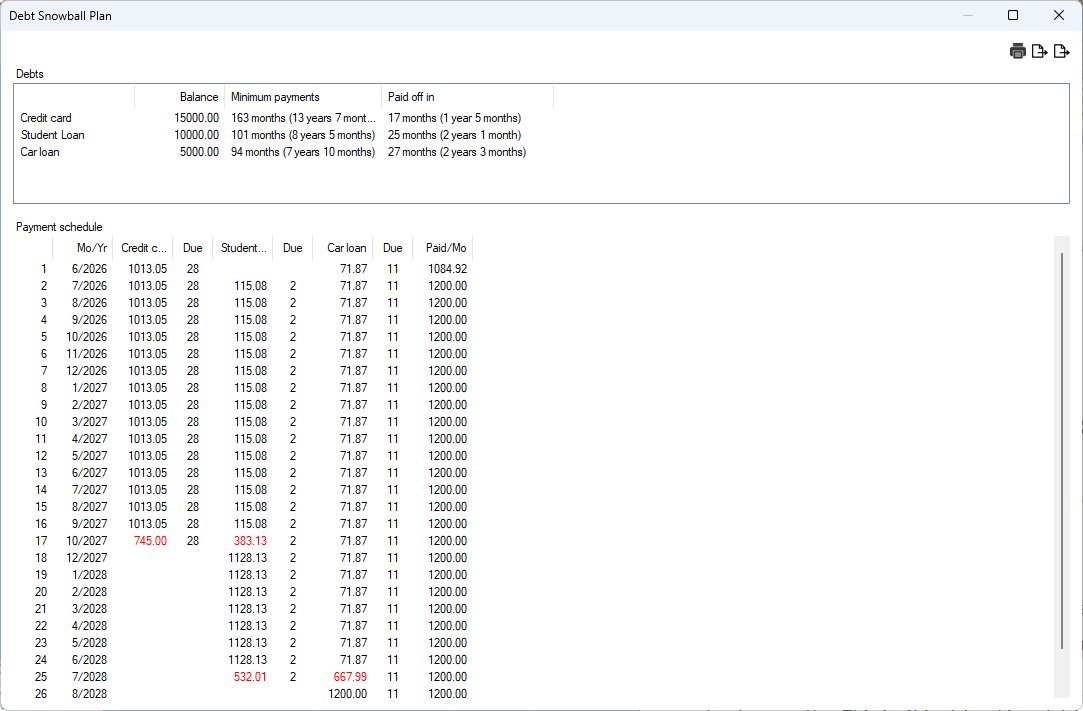

Most budgets address debt with a single monthly number: “Pay $X toward the credit card.”

You Need A Cash Plan goes further:

* Build a custom payoff plan for one debt.

* Create a full debt snowball across multiple balances (example shown).

* Design a custom amortization plan for a credit card with a high balance.

Add your custom payoff plan to your cash plan. See how the plan affects your cash plan over twelve months.

This isn’t just tracking debt—it’s strategically eliminating it.

Budgeting traditionally forces you to change your real plan to test new ideas. You Need A Cash Plan avoids that entirely with built-in “What if?” planning:

1. Clone your existing cash plan.

2. Make changes in the cloned plan (new job, new rent, new car payment, new savings amount, anything). See exactly how the next 12 months change—instantly.

3. Decide if you want to implement the change.

4, Delete the cloned cash plan when you’re done.

Your real plan stays safe and untouched until you’re ready to make a change.

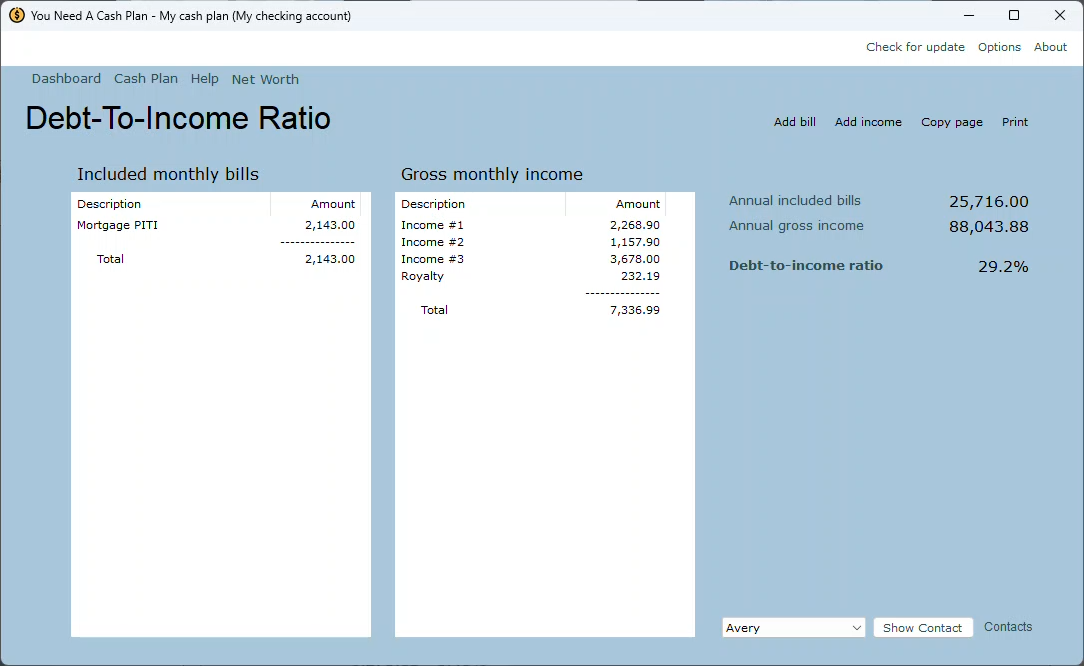

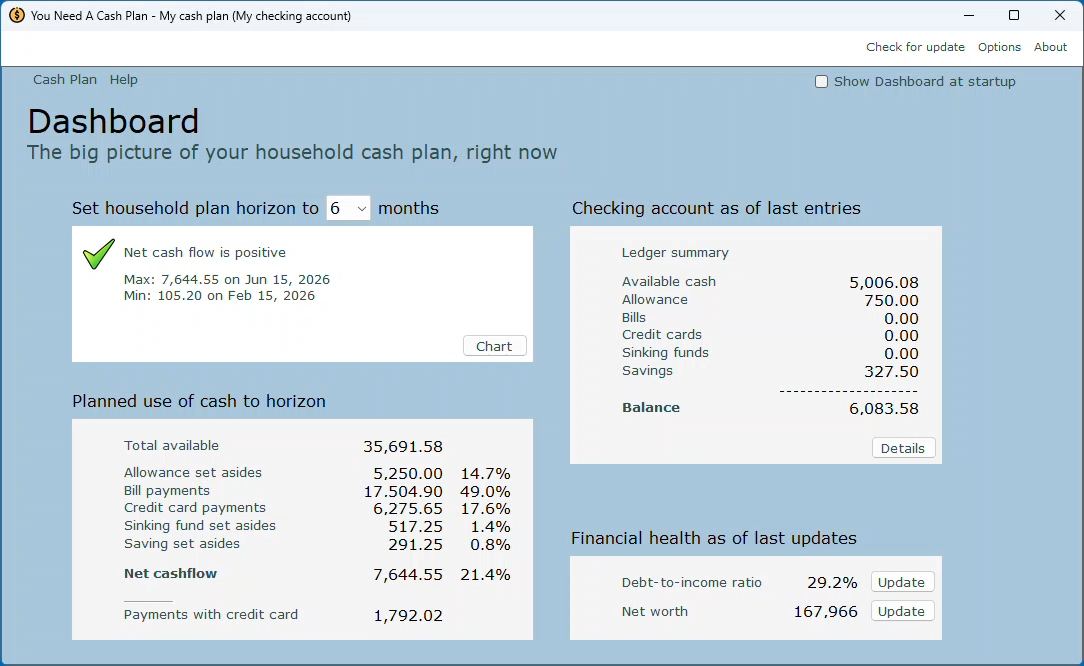

Knowing your debt-to-income ratio gives you a clear, objective snapshot of how much of your income is already spoken for.

It’s a simple way to gauge your financial flexibility: the lower the ratio, the more room you have for saving, investing, handling emergencies, or taking on new opportunities.

Lenders use your DTI to assess risk, but its real power is personal—it helps you see whether your current debt load supports your long-term goals or is quietly limiting your options.

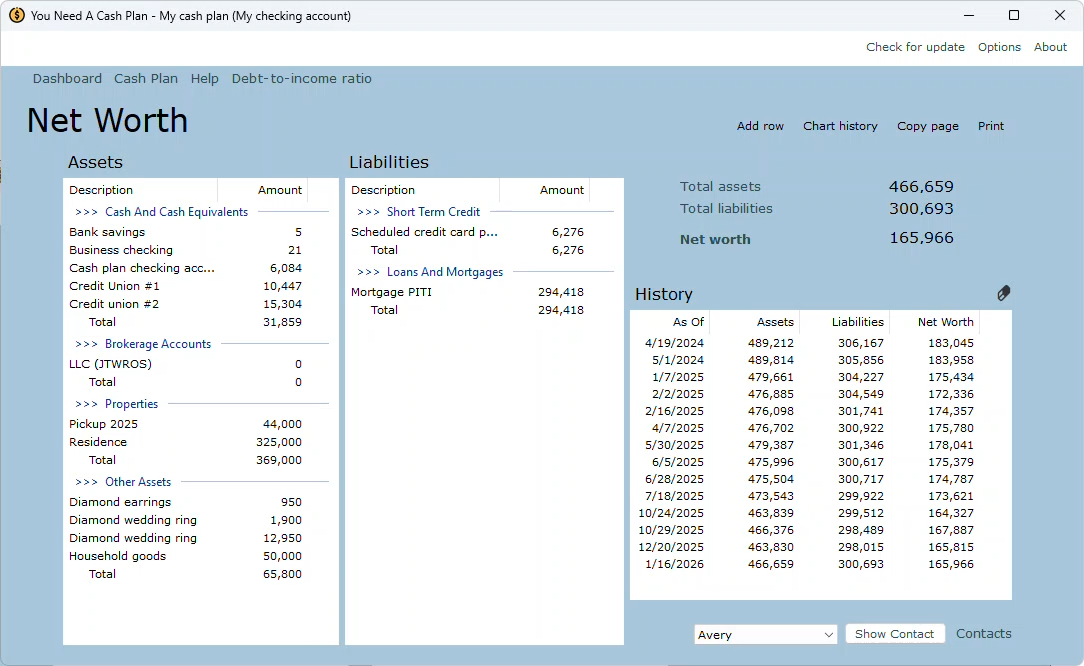

Tracking your net worth helps you see the "big picture" of your financial health—what you own versus what you owe.

Unlike income or monthly budgets, net worth shows your overall progress toward stability and long-term goals. By watching it change over time, you can spot whether your decisions are moving you forward, staying flat, or slipping backward.

Tracking your net worth is a simple, motivating way to measure real improvement and stay focused on building lasting financial strength.

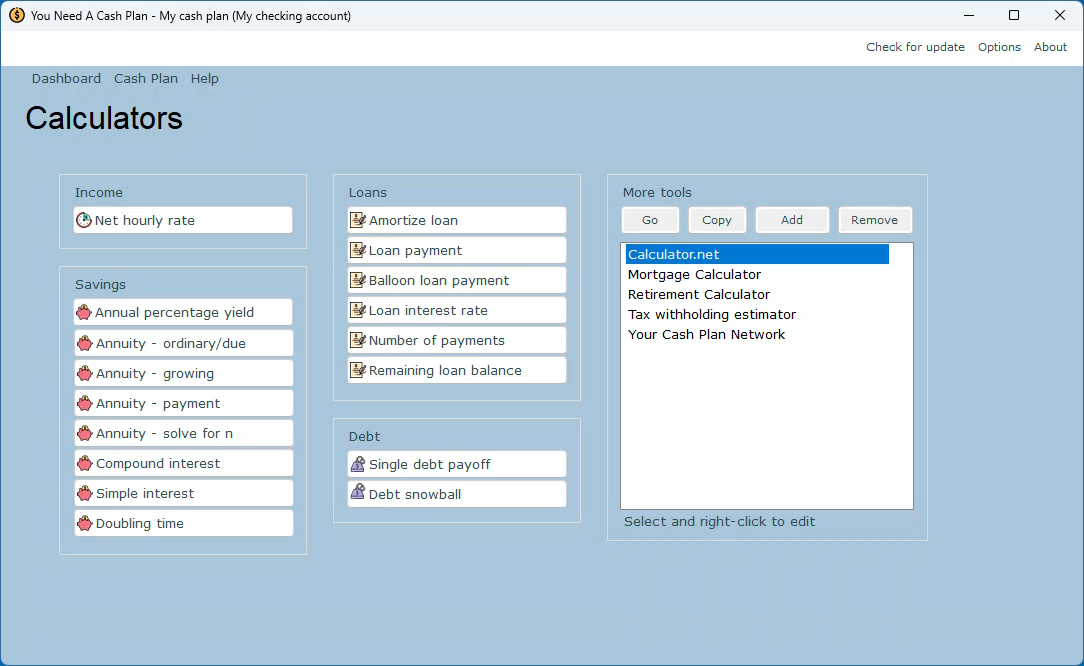

The Calculators page in You Need A Cash Plan gives you quick access to the math behind everyday financial decisions—without needing to hunt for external websites or guess at the numbers.

Whether you are checking loan payments, exploring savings growth, estimating debt-payoff timelines, or running “what-if” scenarios, these built-in tools make it easy to understand the impact before making a move.

And with the “More tools” panel, you can launch trusted external calculators or resources right from within You Need A Cash Plan, creating a convenient, centralized hub for confident, well-informed financial planning.

Budgeting apps often require:

> Account numbers

> Passwords

> Full online access to your accounts

You Need A Cash Plan requires none of that.

> It runs locally on your computer.

> Nothing connects to anything on the Internet.

> Your financial life is not exposed to online risk.

You stay in control.

You Need A Cash Plan helps households by giving them a simple, modern way to see exactly how much money is coming in, going out, and what’s left for the next twelve months. It replaces stress and guesswork with clarity. Families can make decisions with confidence, stay on the same page financially, and finally feel in control of their cash flow without complicated budgeting or spreadsheets.

You Need A Cash Plan helps teach personal finance by giving students a clear, hands-on way to see how cash flow really works. Instead of abstract lessons, learners can practice projecting income, expenses, and what’s left to build real-life money skills that they can use immediately. It makes financial education simple, visual, and practical for any age group.

You Need A Cash Plan helps financial advisors by giving clients a simple, visual way to understand their future net cashflow. Instead of guessing where their money is going, clients come to meetings prepared, aligned, and more confident. Advisors save time, reduce repetitive budgeting conversations, and can focus on higher-value planning because clients finally have a clear, consistent cashflow system they can use at home between sessions.

When planning a path out of debt

You Need A Cash Plan helps you see where your money really goes so you can take control, stop falling behind, and start paying down debt with confidence. You have calculators with which you can create custom payoff plans for one debt, a debt snowball, and amortizing a high balance on a credit card.

You Need A Cash Plan has an Advance Plan feature that helps couples see their full financial picture before they say “I do.” It makes it easy to talk about money, combine plans, and build confidence in how they’ll handle expenses together after the honeymoon.

You Need A Cash Plan strengthens the Financial Fitness Mentor Program by giving participants a simple, practical tool to manage their monthly cashflow. Mentors can focus on guidance instead of spreadsheets while participants gain real clarity, build confidence, and practice healthy money habits between sessions. You Need A Cash Plan makes coaching easier, progress faster, and financial transformation far more sustainable.

You Need A Cash Plan is simple, practical software that automatically organizes your income around real life, not artificial categories or spending rules.

A key aspect of using You Need A Cash Plan is how little of your time is needed. With the program doing the heavy lifting, your involvement in managing your income is greatly reduced compared to maintaining a budget.

Click here for an in-depth comparison of You Need A Cash Plan vs. budgeting.